MVNO – virtual network operators

Why are they popular globally, while they are not in Russia?

How do virtual operators work? Who can make money with this new technology? What are the risks posed by emerging MVNOs observed by classic operators? Pavel Malygin, an expert of Peter-Service, shares on present and future of MVNO projects around the world.

In 1999, the OFTEL (Office of Telecommunications), the British regulator, was the first to coin the MVNO (Mobile Virtual Network Operator) term. At the time, a virtual operator meant a company offering mobile communication services without having necessary radio frequency resources. Since then, companies around the globe ranging from banks to logistics corporations have been creating their own virtual network operators.

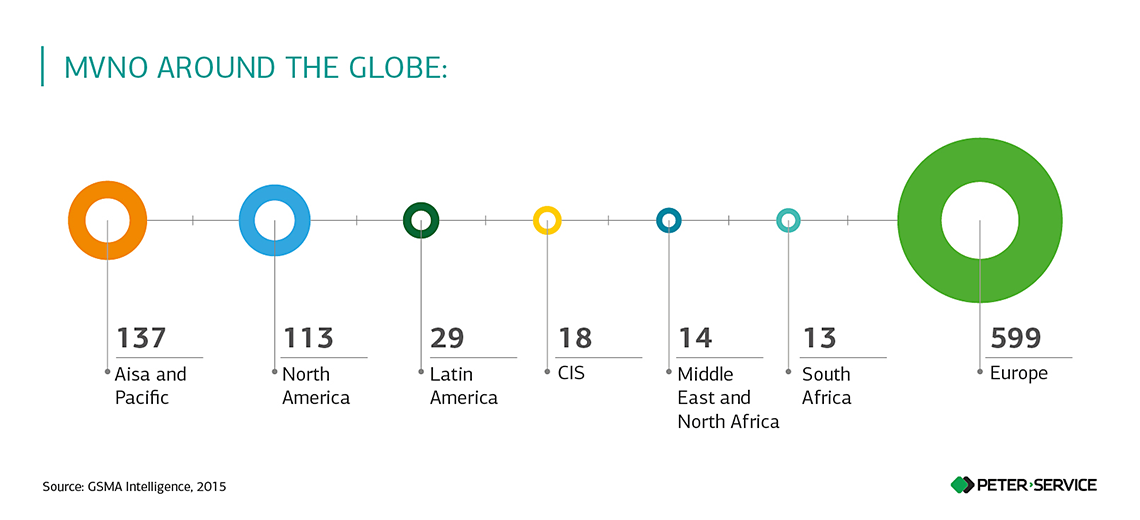

According to 2015 data of GSMA Intelligence, MVNOs are developed mainly in European countries, Asia and North America.

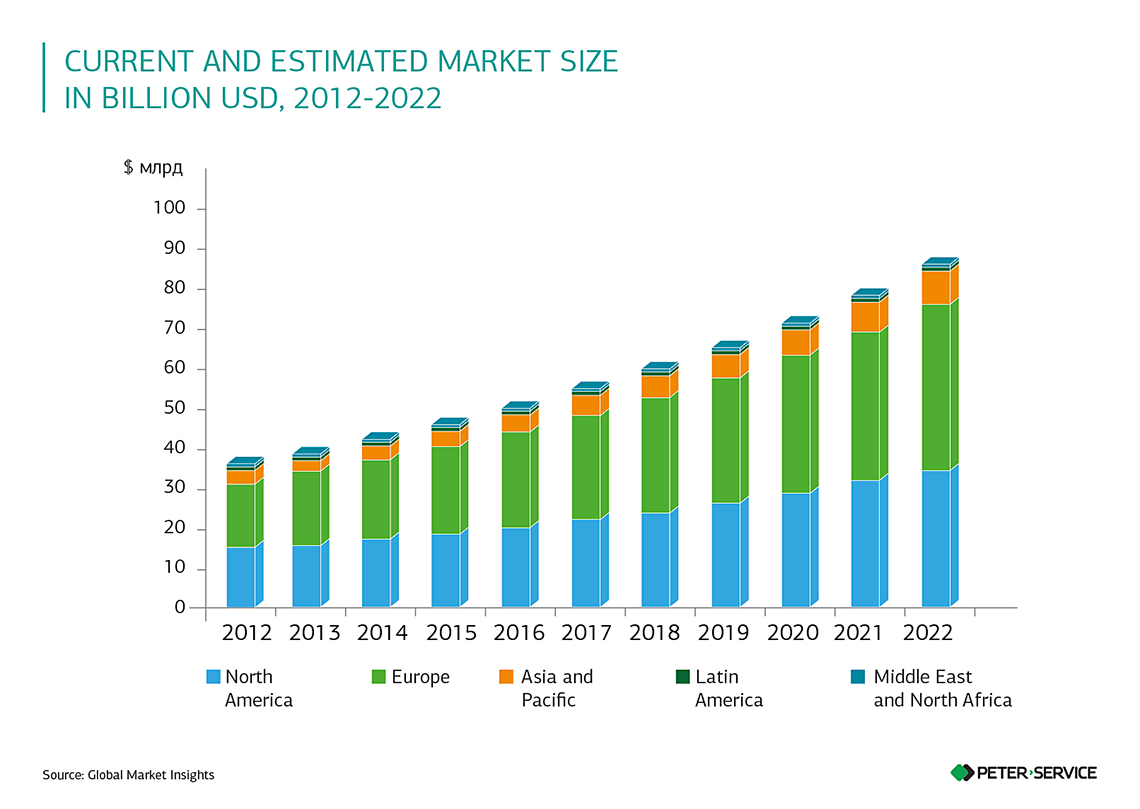

The new Transparency Market Research report says that the world MVNO market will reach 75 bn USD by 2023. The estimated average growth rate during this period between 2015 and 2023 is 7.4 percent. Market growth rate until 2022 is also impressive, Global Market Insights reports.

Virtual network operators – what drives them?

The MVNO technology is a simple opportunity for third companies to enter the mobile communication market. Banks, industrial corporations, retail, transport and logistics, both medium and major businesses, spotted the future potential of MVNO projects long ago.

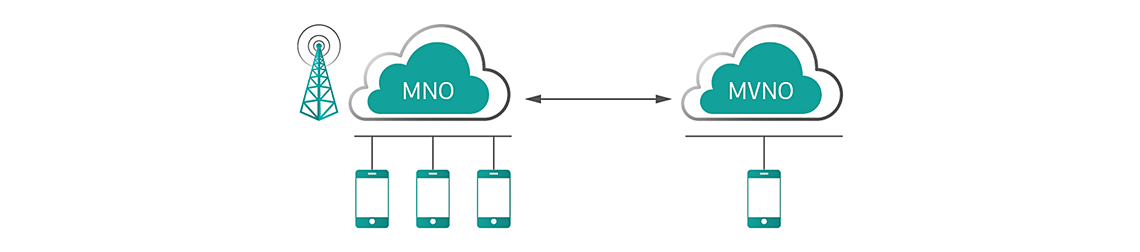

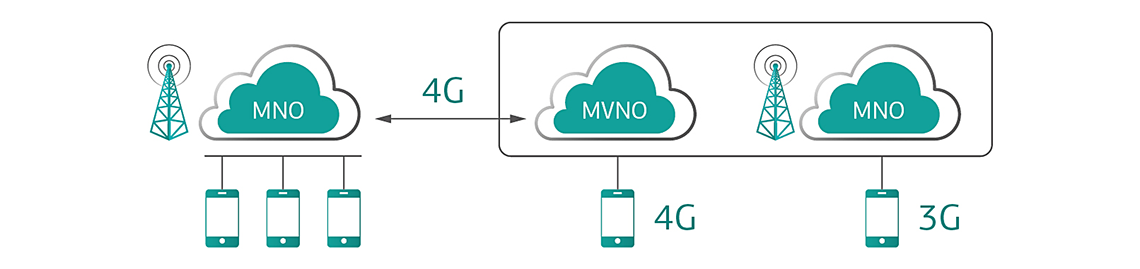

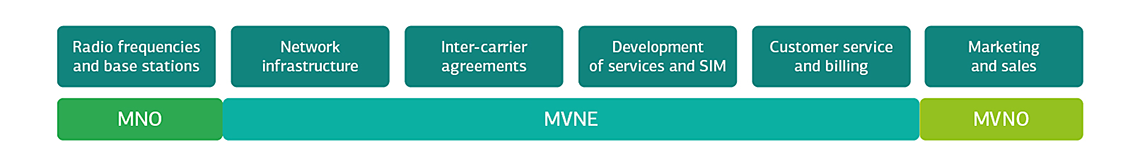

Companies do not need to get licenses and build base stations to set up a virtual operator of their own. They rent the necessary infrastructure, the whole or a part of it, from a host operator – the MNO (Mobile Network Operator). MVNOs work under their own brand and can only exist jointly with MNOs.

A synergy of the core business and telecom services opens new business opportunities for companies helping reduce communication costs and ensure customer loyalty. For a host operator, creating an MVNO helps improve penetration, increase customer base, get additional revenue sources from infrastructure lease, promote new services, and much more.

Depending on the volumes of own and borrowed infrastructure, MVNOs are split into types. The more infrastructure an MVNO owns, the broader is the range of services it can provide to its mobile customers.

Reseller MVNO

The basic MVNO type specializing merely on sales and marketing of the base operator's services under its own brand.

Service Provider MVNO

Besides sales and marketing provides customer service and billing.

Enhanced Service Provider MVNO

Offers added value services, produces its own SIM-cards and tariff plans.

Full MVNO

An MVNO with a maximum infrastructure. On top of everything else, it operates the network with its own switching center, makes national and international roaming and inter-carrier agreements.

MVNO projects are usually launched by companies committed to making money in the mobile market or major corporations concerned to move from the client level to the level of a service provider. Operators enriching their service portfolios with extra mobile offers can also launch MVNOs.

Despite the apparent simplicity, companies may face a number of challenges in setting up a virtual operator. Deploying a proprietary MVNO infrastructure requires a high level of technical competence. Poor expertise in telecom poses a problem for many companies. Ready-made boxed solutions offer a perfect alternative for virtual operators.

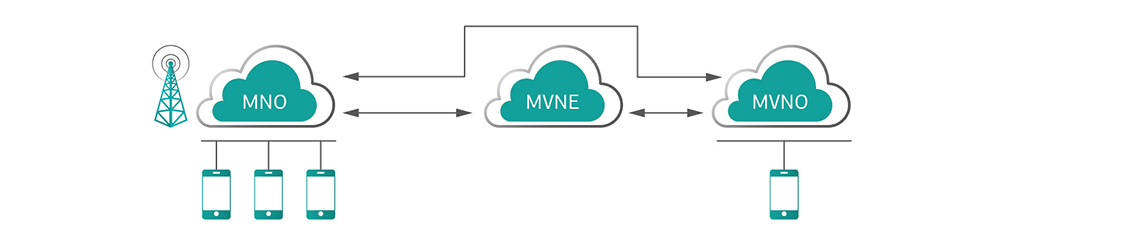

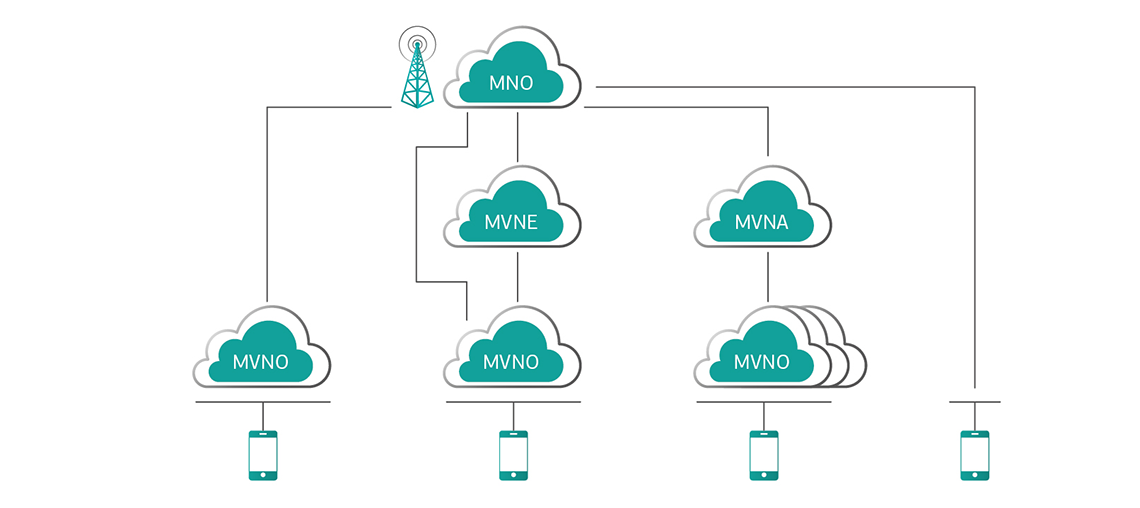

In such a context, so-called "enablers", or MVNE (Mobile Virtual Network Enabler) and aggregators, or MVNA (Mobile Virtual Network Aggregator), facilitate the development of independent MVNOs.

MVNEs are intermediaries between traditional and virtual operators. Enablers commit to solving all technical issues of MVNOs and help save time and costs of putting the MVNO project in operation. MVNEs provide ready-made technical solutions and fix the problems that involve solving non-core tasks for MVNOs.

Working jointly with an MVNE helps virtual operators focus on marketing and sales only, while giving the entire technical part to an outsourced enabler.

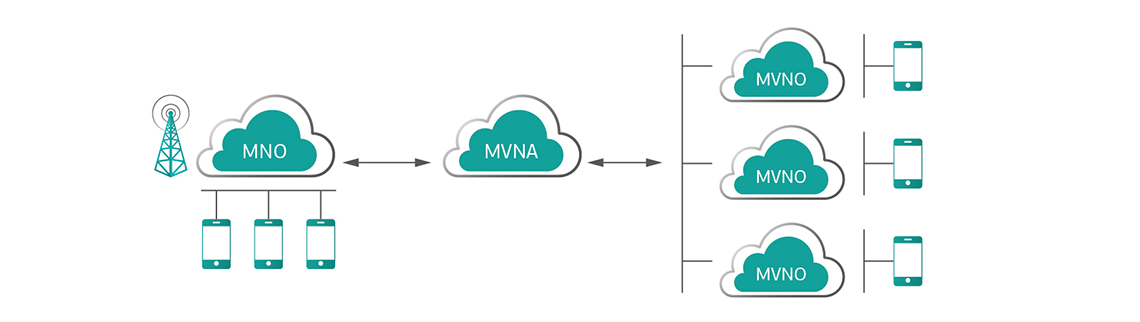

MNOs are interested in working only with major MVNOs with a large base of subscribers. Smaller MVNOs struggle to enter the mobile communication market. This is exactly where MVNAs help small players. They aggregate several smaller virtual operators and cooperate with MNOs as a single major MVNO.

The general scheme of interaction of MNOs with MVNOs, MVNEs and MVNAs can look like this:

MVNO – virtual CSPs in Europe

In Europe virtual operators have over a hundred million subscribers. The spread of MVNOs in this region is due to the activities of regulators and mobile operators. Regulators pursue stronger competition and lower mobile rates and operators are interested that their radio frequencies are used efficiently.

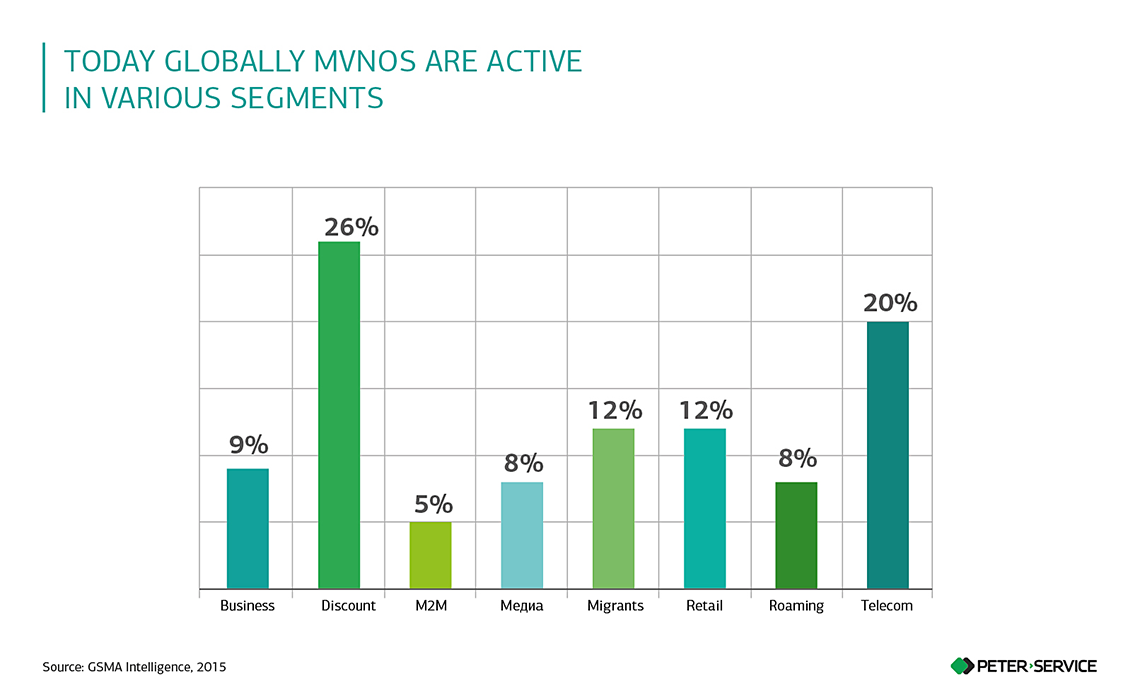

One-quarter of MVNOs in Europe work as discounters offering low-cost services

According to the forecasts of Pyramid Research for 2015-2020, data-MVNOs, M2M and ethnic MVNOs will be the most promising segments for MVNOs in Europe. This almost repeats the Russia-specific forecast of the analytics from J’son & Partners Consulting. Data-MVNOs (international roaming), telecom, ethnic, major corporate MVNOs and M2M/IoT are expected to be the most successful.

MVNO – virtual CSPs in Russia

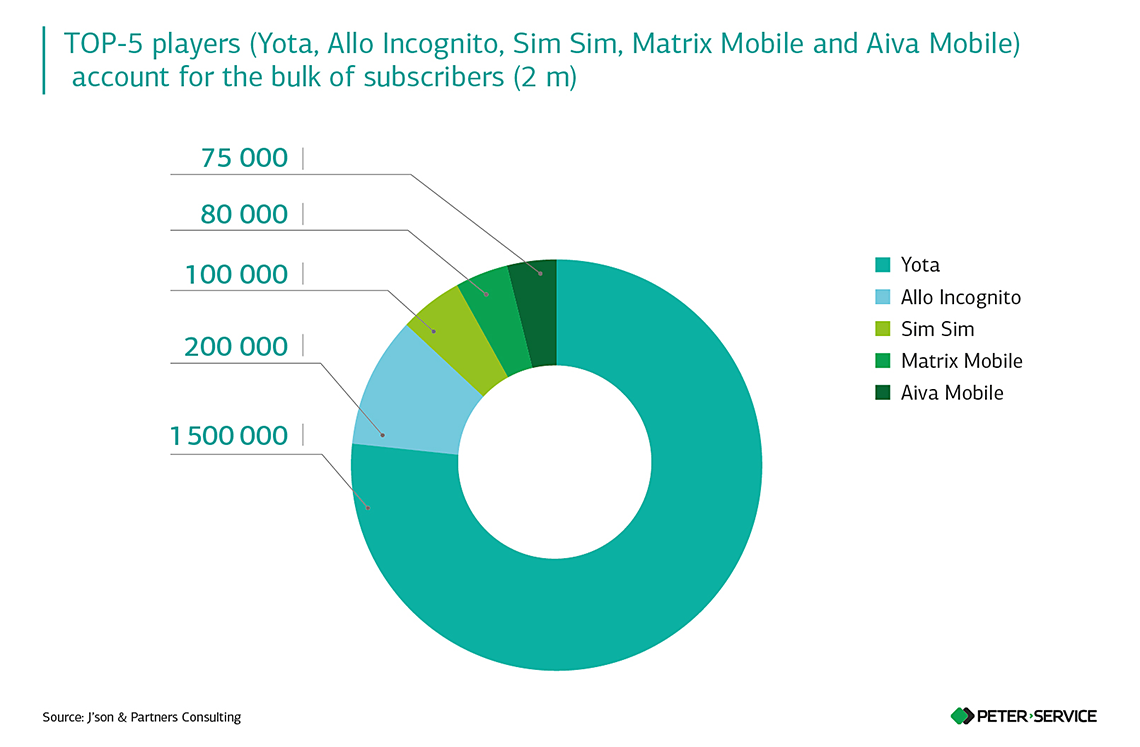

According to TMT Consulting, the number of MVNO subscribers in 2015 more than doubled compared to the previous year reaching 2.5 m. J’son & Partners Consulting predicts that by 2020 the customer base will increase up to 5 m.

Both CSPs and other companies are present in the Russian virtual operator market.

Since 2014 CJSC Gazprom Telecom and Peter-Service have been implementing a project to create a virtual CSP. Rostelecom is testing an MVNO over the network of Tele2 in several Russian regions; subscribers already can purchase SIM-cards of the new operator. Sberbank, also together with Tele2, is working on a new MVNO project for its customers. MegaFon PJSC and Mail.Ru Group started a project to set up a CSP, VKMobile, and are planning to launch it until the end of this year.

Yet, these are just a few projects while, in general, the MVNO market in Russia is poorly developed. The low-cost CSP model that is popular in Europe did not get a foothold locally. For example, MTS and Auchan, an FMCG retail chain, failed to develop the A-Mobile project for supermarket customers. Svyzanoy, a retailer, suspended the operation of Svyaznoy Mobile, a CSP launched in 2013 over the network of MTS, while the MVNO project Alle of X5 Retail Group closed down in 2012 after only two years of operation. CSPs occupied the low-cost rate niche themselves (Tele2).

Experts of J`son & Partners Consulting believe that MVNO development in Russia is, primarily, constrained by mobile operators unwilling to face stronger competition and a lack of pressure from regulators.

Negotiating rental of cell infrastructure with CSPs is hard for independent MVNOs and Full MNVOs also face high capital expenditures related to additional infrastructure.

There is a direct link between the growth of the Russian MVNO and the progress of MVNEs based on major mobile network operators. Yet, independent MVNEs and MVNAs do not exist till today because the conditions of their operation are not defined legally.

With the current challenges, virtual operators still have a future in Russia. Successful projects will be those launched on the basis of well-known mass brands with a big customer base, such as popular banks, payment systems, providers and major companies. As an important factor, they will need to have distributed sales network and a well-developed loyalty program.

Stay connected!